Airport fire exposes costly state negligence

The devastating blaze that gutted the uninsured cargo complex of Dhaka airport on Saturday has laid bare a deep and dangerous negligence in risk management across government installations.Only 86 government establishments, or 14.66 percent of the country's 587 Key Point Installations (KPIs), currently have insurance policies, according to Sadharan Bima Corporation documents. This leaves the vast majority of the KPIs completely uninsured.These uninsured KPIs include strategic national...

The devastating blaze that gutted the uninsured cargo complex of Dhaka airport on Saturday has laid bare a deep and dangerous negligence in risk management across government installations.

Only 86 government establishments, or 14.66 percent of the country's 587 Key Point Installations (KPIs), currently have insurance policies, according to Sadharan Bima Corporation documents. This leaves the vast majority of the KPIs completely uninsured.

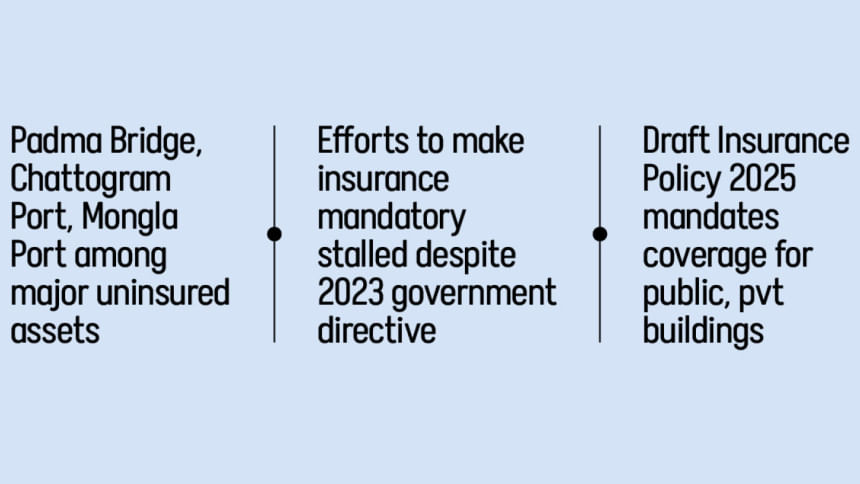

These uninsured KPIs include strategic national assets like the Padma Bridge, Chattogram Port and Mongla Port.

Other critical sites such as the Bangabhaban, Ganabhaban (now being turned into the July Uprising Memorial Museum), Jatiya Sangsad Bhaban, the Secretariat, BTV headquarters, airports, prisons, and major power plants also remain exposed to catastrophic financial loss.

In the absence of insurance coverage, damages from disasters such as fires, vandalism and accidents are ultimately borne by taxpayers.

Unless the government makes insurance mandatory for public assets, experts warn, preventable financial disasters will keep draining public funds.

"Without a binding requirement, most government agencies do not feel compelled to insure public assets," said Mohammad Jainul Bari, chairman of Sadharan Bima Corporation.

Many institutions, including major power plants, avoid insurance due to premium costs, he said. Yet when disasters like fires strike, the government has to bear the full loss from public funds.

"A small premium today could prevent massive financial damage tomorrow. Unless the government makes insurance compulsory, especially for high-value infrastructure, this situation won't change," he added.

Mohd Omar Faruk, secretary at the Chittagong Port Authority, told the Daily Star that no separate insurance has been taken out with any company because doing so would require paying premiums amounting to several crores of taka every month.

"We have a self-insurance fund, where a portion of the profits is allocated regularly. In case of any accident, compensation is paid from that fund, and this has been the port's practice since the very beginning," he said.

FIRE EXPOSES VACUUM

The fire at the import section of Hazrat Shahjalal International Airport's cargo complex raged for nearly seven hours before being brought under control, by which time imported goods stored at the warehouse had been destroyed. It took another 20 hours to completely put out the flames.

The Bangladesh Association of Pharmaceutical Industries estimates that raw materials worth at least Tk 200 crore were destroyed, while the Bangladesh Garment Manufacturers and Exporters Association reported losses of Tk 15.35 crore in products and raw materials belonging to 108 apparel companies.

Industry insiders estimate the total loss could exceed $1 billion while businesses said the losses should not be seen simply at the import value of the items that were gutted. The ripple effects of the fire would heavily fall on both export-oriented garment and pharmaceutical industries, as well as businesses focused on the domestic market.

Biman Bangladesh Airlines and the Civil Aviation Authority of Bangladesh (CAAB) are blaming each other over the absence of insurance for the cargo complex.

"The space and building belong to CAAB, but we rented it to Biman. Biman uses the building for their purpose," said Air Commodore Noor-e-Alam, CAAB member (ATM), admitting that CAAB had taken no initiative to insure the facility.

But Shakil Meraj, director (cargo) at Biman, shifted responsibility back, saying, "CAAB is the owner of the import cargo complex. Biman didn't insure the infrastructure."

PATTERN OF NEGLIGENCE

This is not the first instance of massive state losses without compensation. During the 2024 quota reform protests, Dhaka Metro Rail suffered extensive damage from arson and vandalism. The government received no compensation because the infrastructure was not insured.

A senior Insurance Development and Regulatory Authority (IDRA) official said the government took an initiative in 2023 to make insurance mandatory for all public and private buildings, and the Financial Institutions Division instructed IDRA accordingly.

But the plan has stalled.

Saifunnahar Sumi, media and communication consultant of IDRA, said the issue of making insurance for public and private buildings has now been incorporated into the draft Insurance Policy 2025.

Another senior IDRA official said that in 2023, the regulator even developed a dedicated insurance product for public assets after discussions with the Bangladesh Investment Development Authority.

It also recommended amending the Building Code, but no progress has been made.

"Despite repeated government directives, the plan to bring all public and private buildings under mandatory insurance remains unimplemented," said Adeeba Rahman, first vice-president of the Bangladesh Insurance Association.

"The issue resurfaces each time a major fire breaks out, but to no avail. Without insurance, there is no compensation."

Citing the Dhaka airport cargo fire, she said, "Had it been insured, the government could have claimed compensation. Now the entire financial loss will be borne by the state, meaning the taxpayers."

NOT JUST COMPENSATION

Md Main Uddin, professor and former chairman of the Department of Banking and Insurance at Dhaka University, said the failure stems from a flawed mindset.

"People think disasters are rare, so they avoid insurance. The government often shares that view. They don't want to pay regular premiums for events that may not happen again for 50 years."

He said limited government revenue, lack of awareness, and no legal obligation are the three major obstacles.

Because of low revenue, the government prioritises only the most essential expenditures and often overlook the risk of major though rare disasters.

"Infrastructure like the metro rail or the cargo complex is nationally significant. Insurance cannot recover lost time or business, but it ensures financial recovery," Main Uddin said.

He added that many developed nations require insurance even for low-risk infrastructure. "It's not about frequency. It's about preparedness."

If insurance were made mandatory, awareness would increase, said Main Uddin. Moreover, once insurance is made mandatory, incidents may decrease due to improved precautions, he added.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, said the airport fire is a wake-up call for strengthening government security to protect all installations.

"National assets worth billions should not be left unprotected. These disasters are not only causing loss of national assets, but become a taxpayer's burden," she said.

"The government must urgently make insurance coverage mandatory for all Key Point Installations, backed by proper valuation, monitoring, and accountability. Without that, every blaze will keep burning public money and eroding public trust," she added.

[Dwaipayan Barua contributed to this report]